10 Defensive Stocks for March 2025

Your Guide to Staying Calm (and Profitable) in a Chaotic Market

Total Portfolio: $55,520

Day 180 | $21,379 (Fidelity)

Day 546 | $34,139 (Ally)

Hey there, fellow investor!

If you’ve opened your portfolio this year and felt like you’re watching a thriller movie—complete with plot twists and jump scares—you’re not alone (my portfolio is down $1,500 in just 4 days). 2025 has been a bumpy ride so far, with inflation hiccups, geopolitical drama, and markets that swing wildly based on the day’s headlines.

But guess what? Chaos can be your friend if you know where to look. Just like storms reveal which trees have the deepest roots, tough markets highlight the stocks that can weather almost anything. They might not be glamorous, but they’ll save you when things get messy.

Today, I’ll walk you through 10 defensive stocks in my own portfolio that are outperforming the market this year (as of March 5, 2025). We’ll talk about why they’re thriving, how to spot similar opportunities, and most importantly—how you can use this strategy to protect and grow your money, no matter what 2025 throws at us.

Why Defensive Stocks? (Spoiler: They’re Boring… In a Good Way)

What Makes a Stock “Defensive”?

Defensive stocks are companies that sell things people need, not just want. Imagine a zombie apocalypse (stick with me here). You’d prioritize bottled water, canned food, and bandages over designer shoes or a new iPhone, right? Defensive stocks work the same way. They’re in industries like:

Healthcare (you can’t skip heart medication).

Utilities (everyone needs electricity).

Groceries (hunger doesn’t care about inflation).

Everyday services (like payroll software for businesses).

These companies tend to hold up better when the economy wobbles because their products stay in demand. For example, General Electric (GE)—yes, the lightbulb folks!—is up over 20% this year because they make jet engines. Even in tough times, planes need repairs.

Why 2025 May Be the Perfect Time to Go Defensive

This year’s market has been ever changing:

Interest rates keep moving.

Gas prices are all over the place.

The news cycle feels like a soap opera.

But here’s the silver lining: Uncertainty helps us spot tough stocks. If a company is growing while others struggle, it’s probably built to last. Let’s look at some of my winners so far in 2025.

Top 10 Defensive Stocks in My Portfolio

(Note: All returns are as of March 5, 2025, and compared to the S&P 500’s -2% YTD loss.)

1. General Electric (GE) – Up 21%

What they do: Make jet engines and wind turbines.

Why it’s defensive: Air travel and clean energy aren’t going away and GE’s engines power 1 in 3 commercial flights.

Beginner takeaway: Look for companies that “keep the world running” behind the scenes.

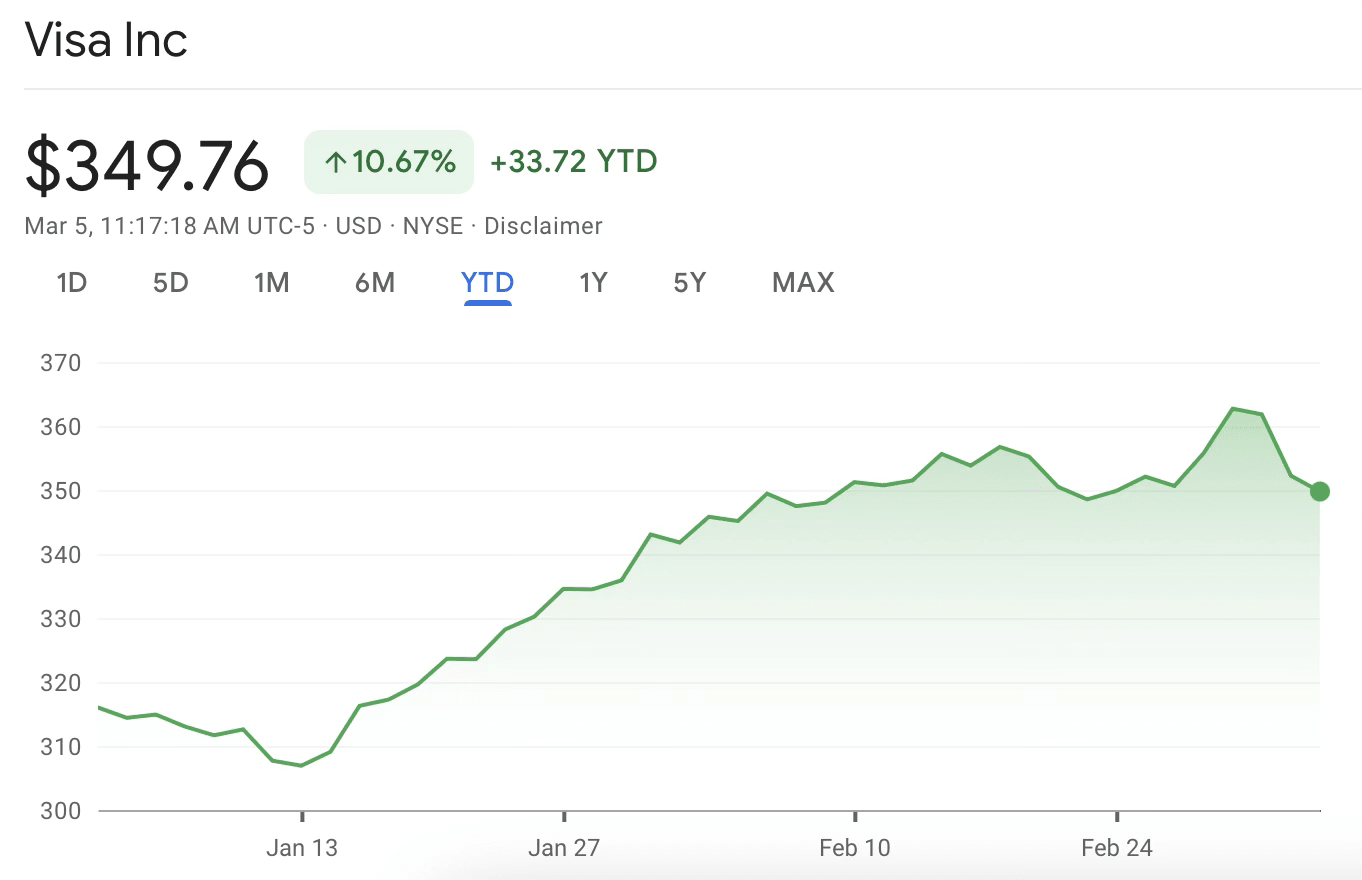

2. Visa (V) – Up 10%

What they do: Process credit/debit card payments.

Why it’s defensive: Even in recessions, people still buy groceries and pay bills. Visa takes a tiny cut of every transaction—and processed $3.2 trillion this quarter.

Beginner takeaway: “Invisible” services (like payment networks) can be goldmines.

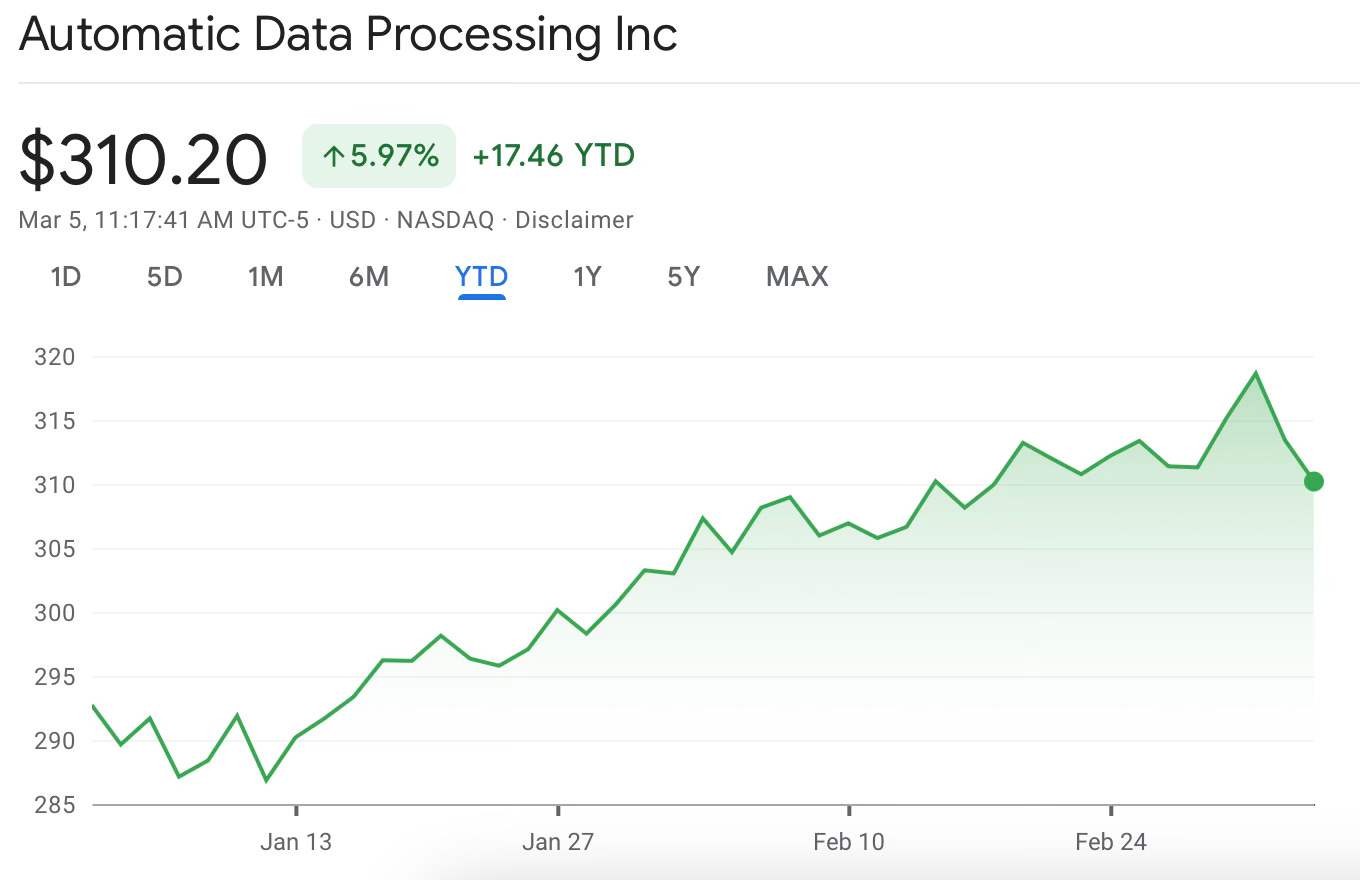

3. Automatic Data Processing (ADP) – Up 6%

What they do: Handle payroll for businesses.

Why it’s defensive: Companies have to pay employees, rain or shine. ADP’s software is used by 1 in 6 U.S. workers.

Beginner takeaway: Recurring revenue = reliable growth.

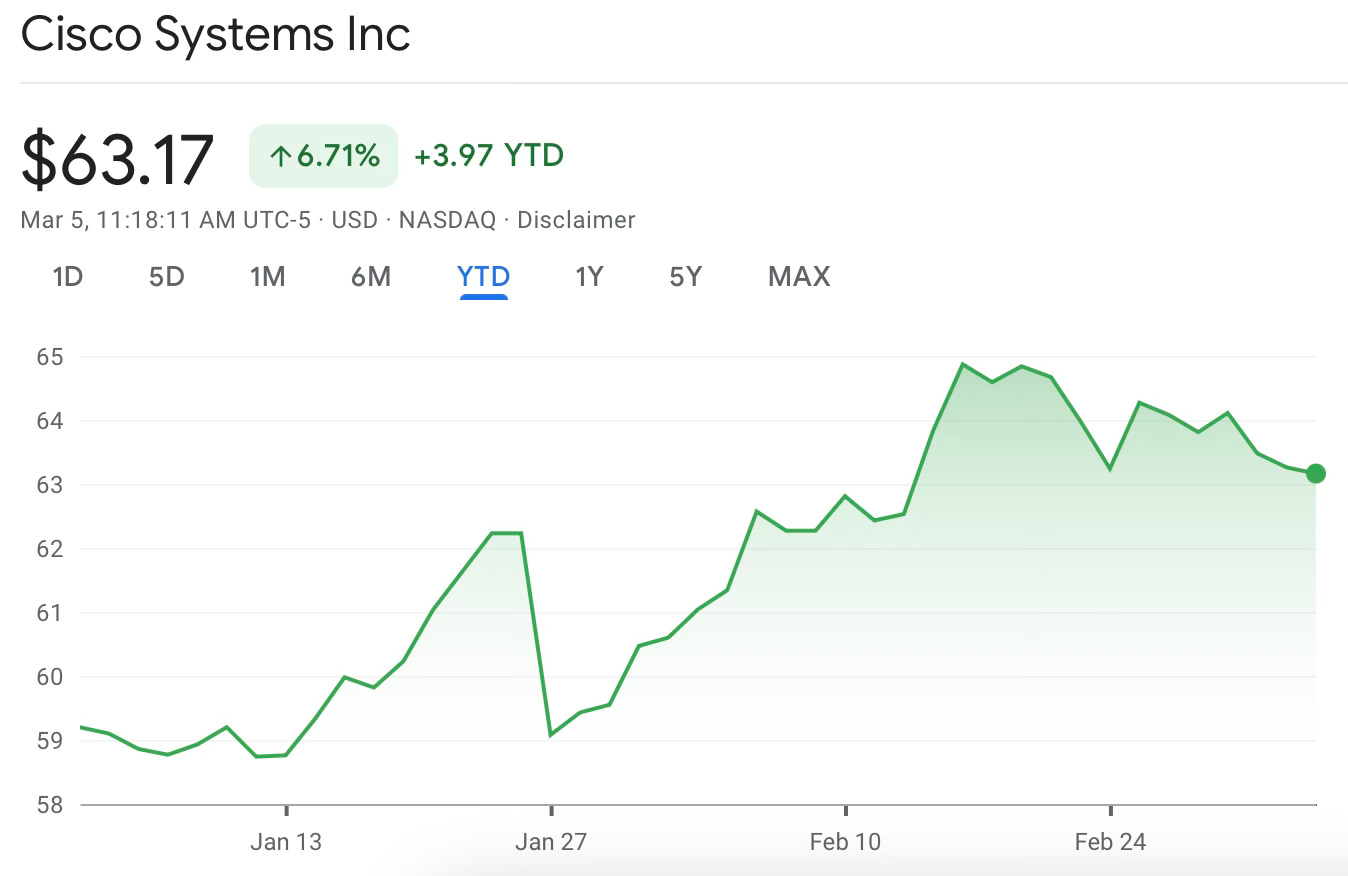

4. Cisco Systems (CSCO) – Up 6%

What they do: Make internet routers and cybersecurity tools.

Why it’s defensive: The internet isn’t optional anymore. Cisco’s tools keep businesses online safely.

Beginner takeaway: Tech can be defensive if it’s essential (like cybersecurity).

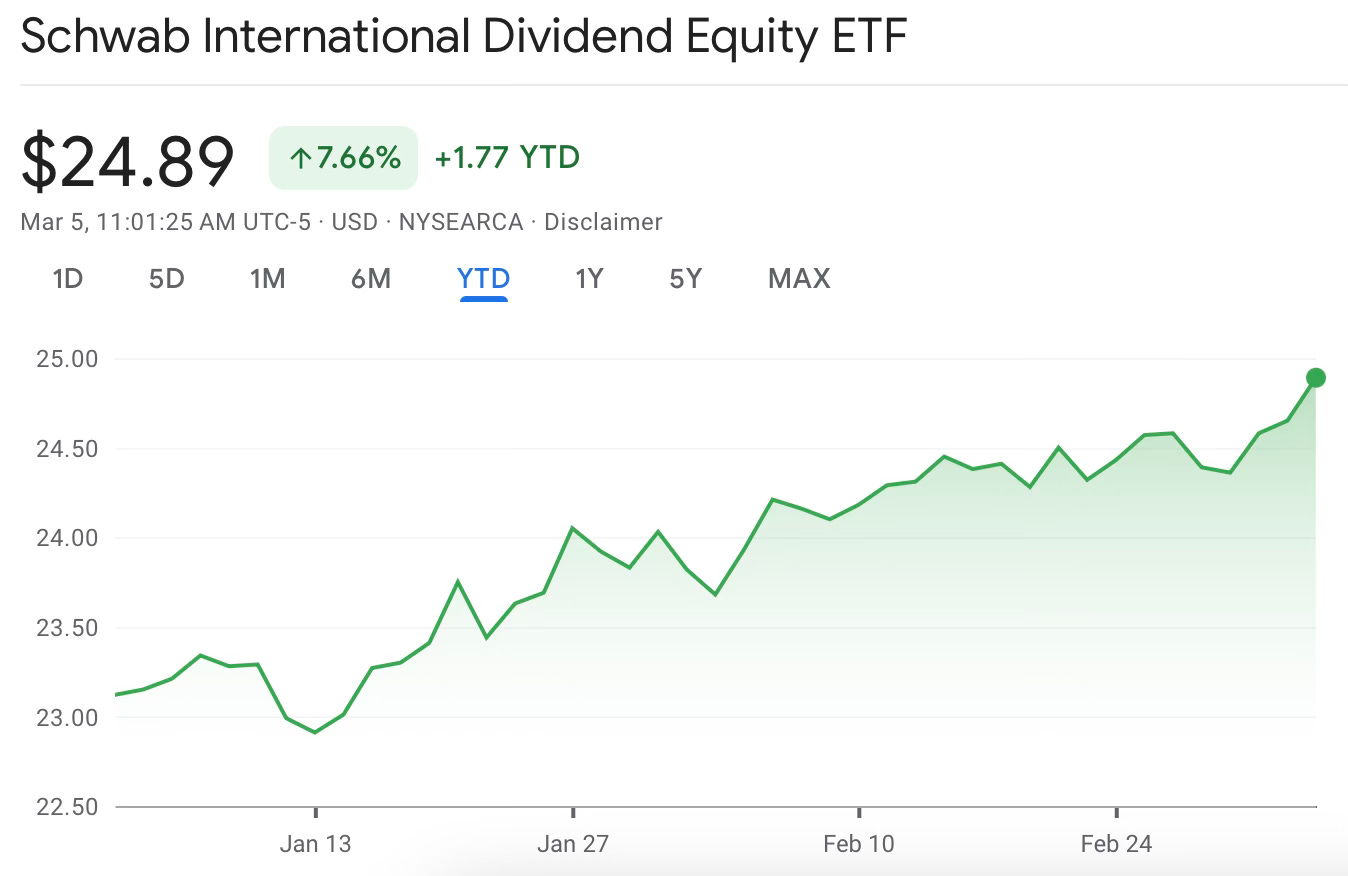

5. Schwab International Dividend ETF (SCHY) – Up 7%

What it is: A basket of global dividend-paying stocks (like Nestlé, Unilever).

Why it’s defensive: International diversification + steady dividends..

Beginner takeaway: ETFs let you own 100+ stocks for the price of one.

6. Agree Realty (ADC) – Up 6%

What they do: Owns resilient retail properties like Walmart and Dollar General.

Why it’s defensive: People always shop for basics. ADC gets rent even if sales dip.

Beginner takeaway: Real estate can be low-risk if tenants are recession-proof.

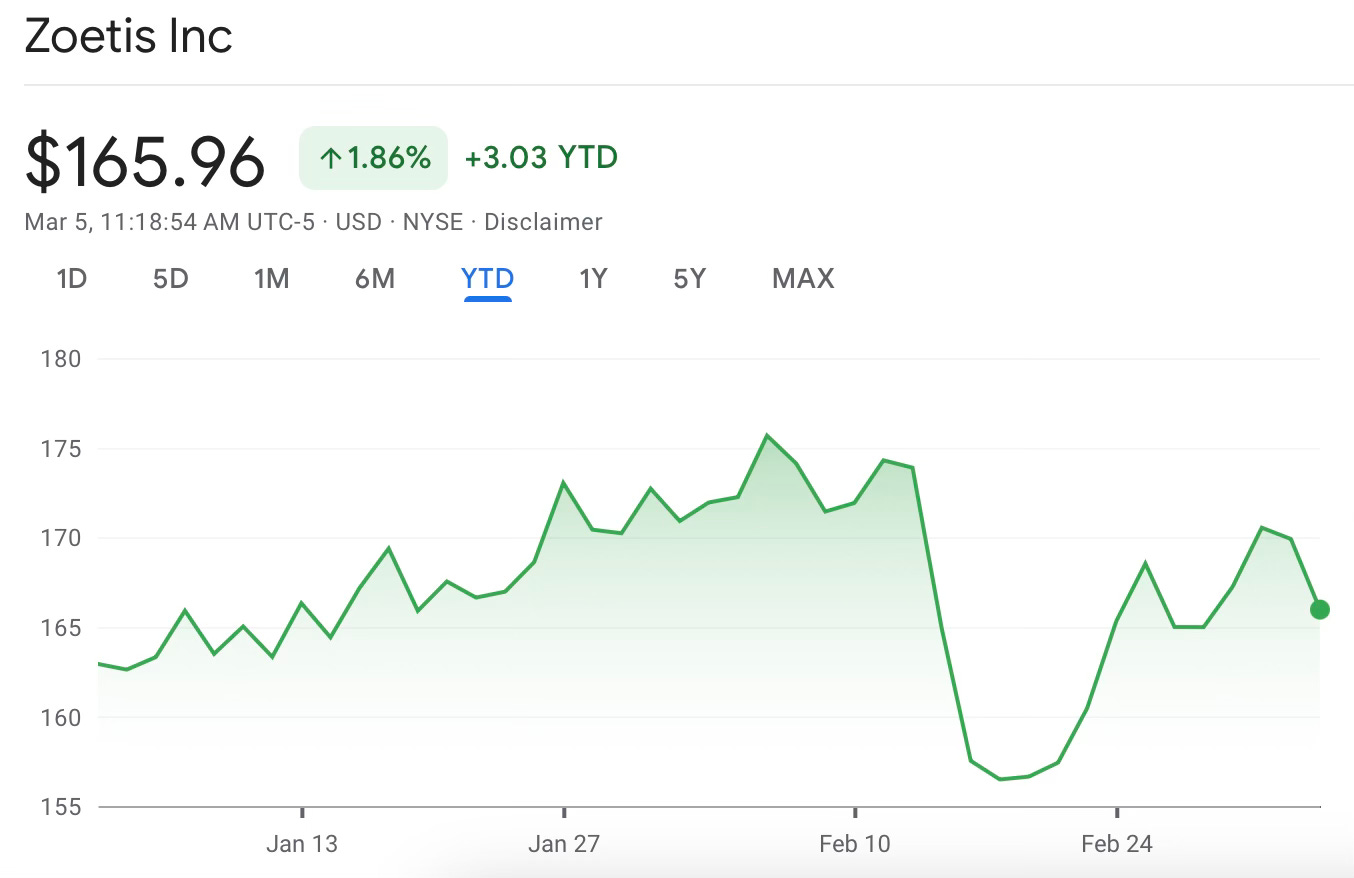

7. Zoetis (ZTS) – Up 2%

What they do: Make medicine for pets and farm animals.

Why it’s defensive: Pet owners prioritize their fur babies’ health over many things!

Beginner takeaway: “Love-driven” spending (pets, kids) is usually a top priority.

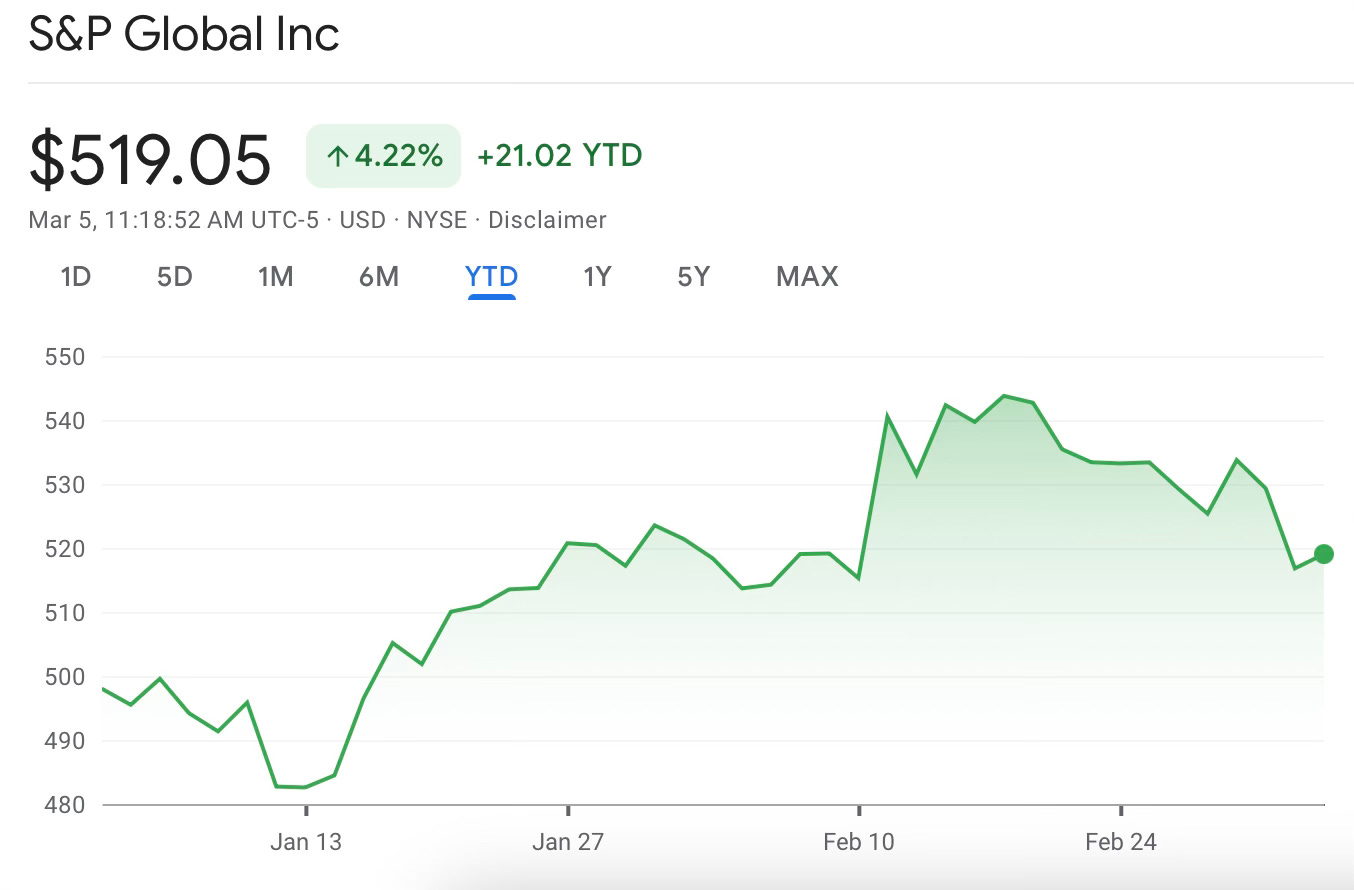

8. S&P Global (SPGI) – Up 4%

What they do: Rate companies’ credit (like report cards for debt).

Why it’s defensive: Investors need trustworthy data during chaos.

Beginner takeaway: Companies that “grade” others often thrive in crises.

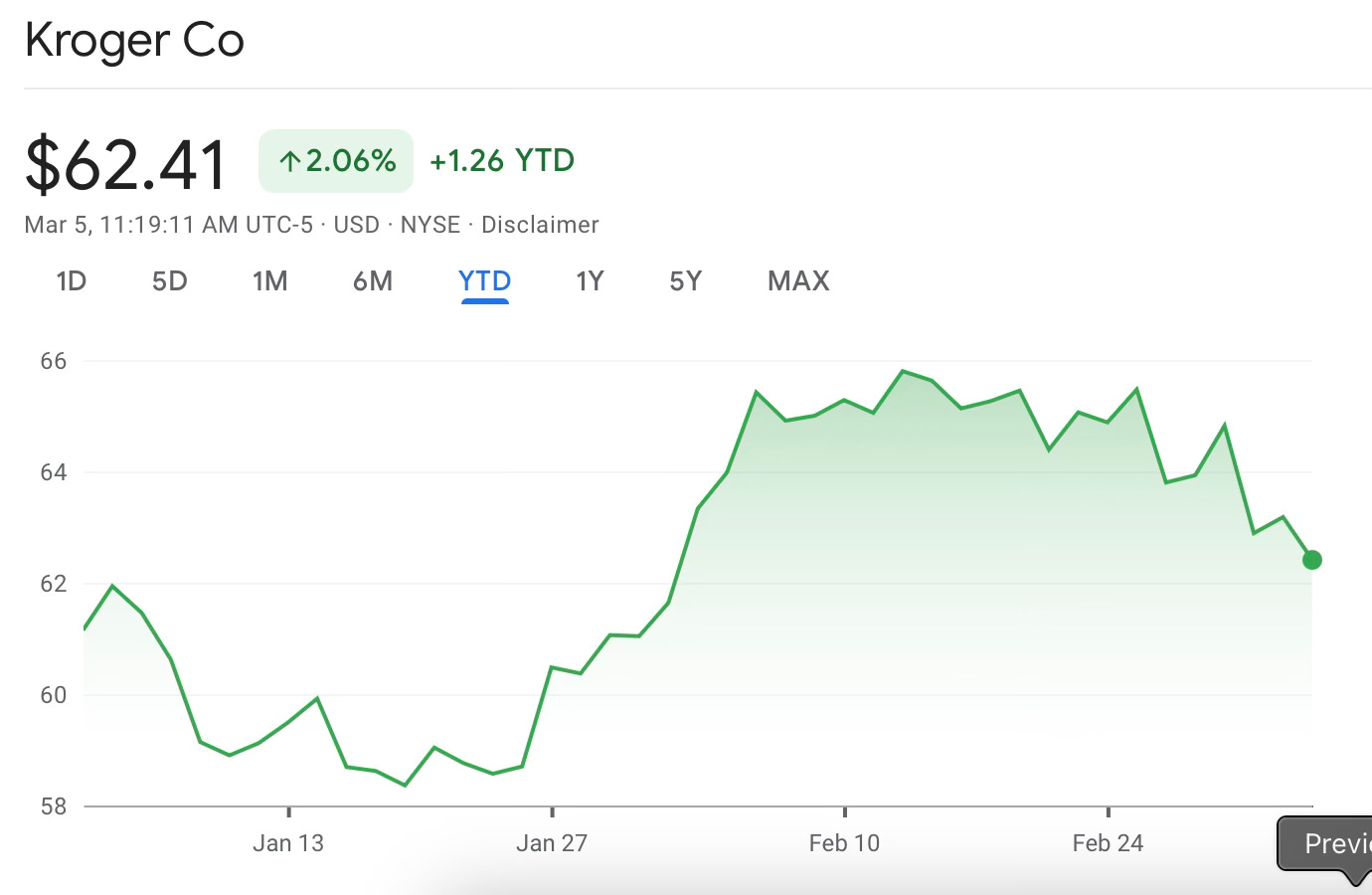

9. Kroger (KR) – Up 2%

What they do: Run the #2 grocery store in the US behind Walmart.

Why it’s defensive: Everyone eats! Kroger’s loyalty program locks in shoppers.

Beginner takeaway: Boring industries can be beautiful.

10. Alexandria Real Estate (ARE) – Up 3%

What they do: Rent labs to biotech companies.

Why it’s defensive: Cancer research doesn’t stop for recessions.

Beginner takeaway: Niche real estate (labs, hospitals) = hidden gems.

How to Copy This Strategy with No Finance Degree

Step 1: Check Your Portfolio’s “Defense Score”

Look at your stocks and ask:

Do they sell something people need?

Have they grown during past recessions?

Do they pay dividends? (Extra cash = cushion during downturns.)

Step 2: Balance Defense and Offense

Even defensive stocks shouldn’t be your whole portfolio. Aim for:

“Defense”: Staples, utilities, healthcare.

“Offense”: Growth stocks (tech).

Cash on Hand: To buy discounts during market dips.

Step 3: Stay Calm and Keep Investing

Defensive stocks aren’t about getting rich overnight—they’re about sleeping well at night. Set up automatic investments (even $50, $100, or $500 a month!) and let time do the heavy lifting.

Final Thoughts: You’ve Got This!

2025 might feel overwhelming, but remember: Every great investor started where you are now. By focusing on companies that solve real-world problems (like keeping lights on, families fed, or data secure), you’re not just surviving this market—you’re setting yourself up for decades of steady growth.

So grab a coffee, ignore the scary headlines, and take pride in building a portfolio that’s as resilient as you are. 💪

Until next time, keep walking!

Jeremy ✌️

And before you leave…

Disclaimer

This article is for informational and educational purposes only. I am not a financial advisor, broker, or tax professional. The information provided reflects my personal opinions and experiences as an individual investor and may not be accurate or current. All investment strategies and investments involve risk of loss. Any ideas presented may not be suitable for all investors and may not take into account your specific investment objectives, financial situation, or needs. Past performance is not indicative of future results. Always conduct your own due diligence and consult with qualified financial professionals before making any investment decisions.