The Path to Real Estate Wealth Without the Landlord Headaches

Why I choose real estate investment trusts (REITs) over rental properties

Total Portfolio: $57,052

Day 176 | $21,915 (Fidelity)

Day 542 | $35,137 (Ally)

Real estate has always been a big part of my life and career journey. While I love the design gig I have now, I took an unusual path to get here.

Back in college, I double-majored in design and real estate, which led me to work as a real estate agent, leasing consultant, and title underwriter early in my career. My love for properties began in college when I helped my parents renovate houses – an experience that inspired me to buy my own fixer-uppers. So far, I've lived in and renovated 8 homes, learning valuable lessons with each project.

Despite this hands-on background, my preferred way to invest in real estate today isn't through physical properties but through REITs (Real Estate Investment Trusts). They give me the benefits of owning real estate without many of the headaches that come with being a landlord.

My Journey from Renovation to REIT Investing

Working on home renovations taught me firsthand about the work, costs, and challenges of real estate. Each project came with lessons about unexpected expenses, dealing with contractors, and navigating building codes. While rewarding, these experiences showed me how much time and stress goes into managing physical properties.

This led me to look for easier ways to invest in real estate, which is how I discovered REITs. These are companies that own, operate, or finance income-producing real estate across different sectors. They let you earn income from real estate without having to buy, manage, or finance properties yourself. When they're publicly traded, you can buy and sell shares just like stocks, making them much easier to get in and out of than physical properties.

REITs were created by Congress in 1960 to give everyday investors access to real estate investments. One thing that makes them special is they must pay out at least 90% of their taxable income as dividends to shareholders each year. This creates a great way to earn passive income while still being invested in real estate.

My First REIT Investment: ADC (Agree Realty Corporation)

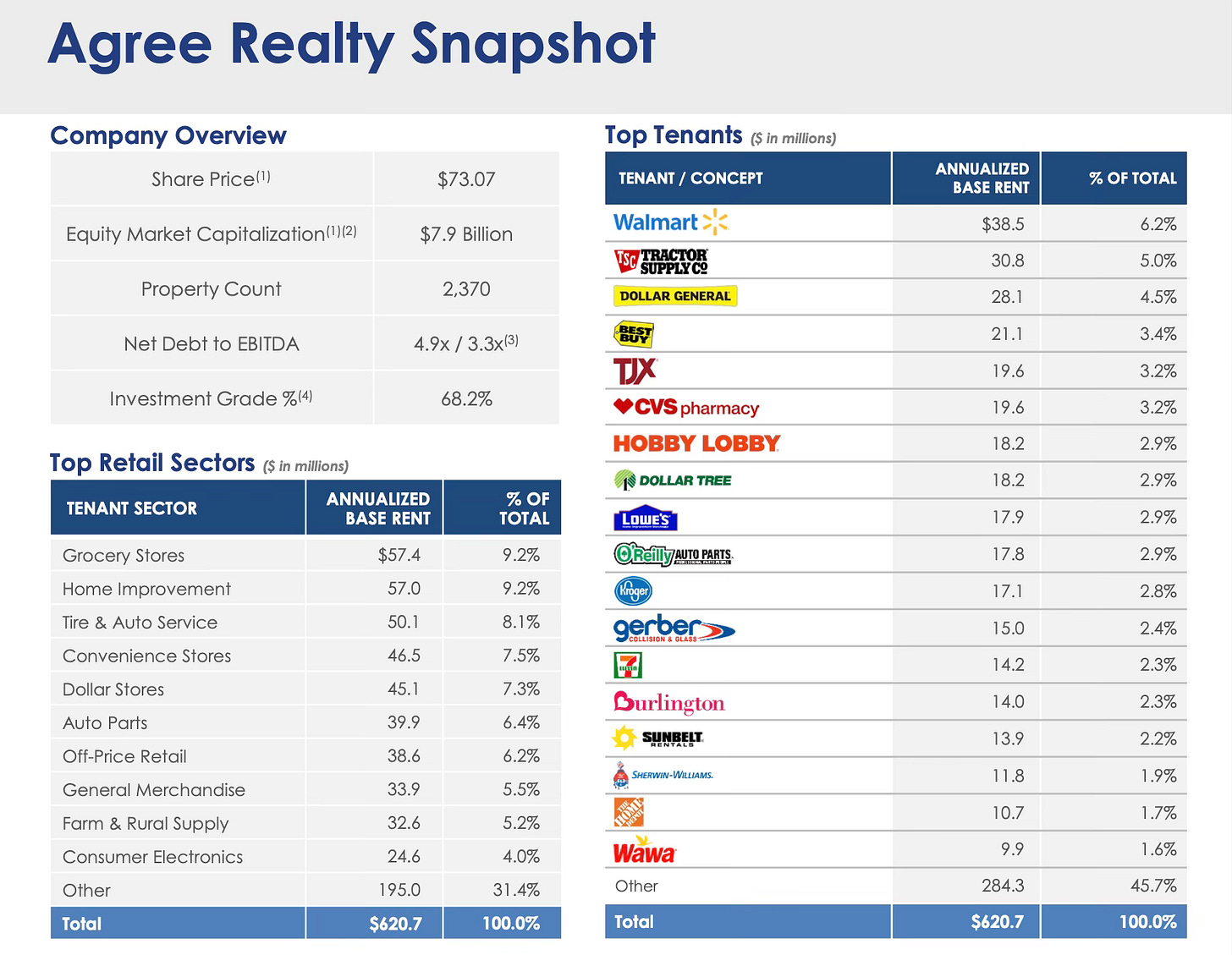

I first dipped my toes into REIT investing with Agree Realty Corporation (NYSE: ADC). This company focuses on retail properties that are net leased to major retail tenants. Their portfolio includes over 2,000 properties across 49 states, with tenants like Walmart, Tractor Supply, Best Buy, and Dollar General.

What attracted me to ADC was their "net lease" model. This means tenants pay for most property expenses like taxes, insurance, and maintenance. It creates steady, predictable income with minimal management hassles – exactly what I wanted in a passive investment.

Since investing in ADC in September 2023, it's grown to about 5.5% of my investment portfolio. I've enjoyed impressive returns with about 27.6% growth in share value. Even better is the 5.26% yield on cost, giving me steady passive income that grows as I reinvest dividends.

The Challenges of Physical Real Estate Investing

Tenant Troubles and Management Headaches

Being a landlord can be incredibly stressful. I saw this with my parents' rental properties. Even with careful background checks, they still ran into problem tenants. I remember countless late-night emergency calls about plumbing disasters – one tenant seemed to have a special talent for clogging toilets at midnight! Even worse was their experience with a tenant who simply stopped paying rent, leading to a long eviction process. All while the mortgage, taxes, and insurance payments kept coming due, creating serious financial strain.

Capital and Financial Risk

Physical properties tie up a lot of money in one place. The down payment and closing costs for an investment property can lock up hundreds of thousands of dollars in a single asset, in one location. This makes you vulnerable to local market downturns, natural disasters, or neighborhood problems.

The Illiquidity Challenge

Physical real estate is hard to sell quickly. Unlike stocks or REITs that you can sell in minutes during market hours, selling a property takes months and comes with hefty costs like real estate commissions and legal fees. This becomes a real problem if you face a financial emergency or if the market suddenly drops.

Time-Intensive Management Requirements

Managing rental property either takes your time or your money. If you self-manage (like my parents did), you're handling tenant screening, rent collection, maintenance, and legal compliance – basically taking on a part-time job. If you hire a property manager, you'll typically pay 8-12% of your rental income, cutting into your returns. Either way, it's not truly passive.

The Advantages of REIT Investing

True Passive Income Without Management Burdens

REITs offer a simpler alternative that addresses many of these challenges while still giving you exposure to real estate. The biggest advantage is truly passive income without property management headaches. As a REIT shareholder, you get dividends without dealing with tenant issues, maintenance problems, or vacancies. Professional teams handle all the day-to-day operations.

Built-In Diversification Across Properties and Markets

REITs instantly diversify your real estate investments across multiple properties, locations, and sometimes different property types. This reduces the risk that comes with owning just one or two properties. My own REIT portfolio shows this benefit – it includes retail, life sciences, mixed-use developments, single-family rentals, and global industrial properties.

Superior Liquidity and Financial Flexibility

Publicly traded REITs offer great liquidity. You can buy or sell shares any time during market hours, with minimal transaction costs compared to physical real estate. This flexibility gives peace of mind, knowing you can access your money quickly if needed.

Lower Barriers to Entry

REITs are more accessible than direct property ownership. You can start investing with modest amounts rather than saving for years to build up a down payment. This makes real estate investing available to more people, regardless of their net worth or ability to get mortgage financing.

Exploring My REIT Portfolio Diversity

One thing I love about REIT investing is being able to target specific types of real estate that interest me. My current portfolio shows how diverse the REIT sector really is.

Agree Realty Corporation (ADC) is the foundation of my REIT investments with its focus on retail properties. They specialize in properties leased to essential retailers with strong credit ratings, which provides stability even during economic downturns. Their triple-net lease structure, where tenants handle property expenses, creates reliable income streams with minimal management needs.

Alexandria Real Estate Equities (ARE) gives me exposure to the growing life science real estate sector. They develop and operate research campuses “Mega Campus” in innovation hubs like Boston, San Francisco, and Research Triangle. Their buildings house pharmaceutical, biotech, and tech companies doing cutting-edge research. This focus positions ARE to benefit from the expanding healthcare and biotech sectors.

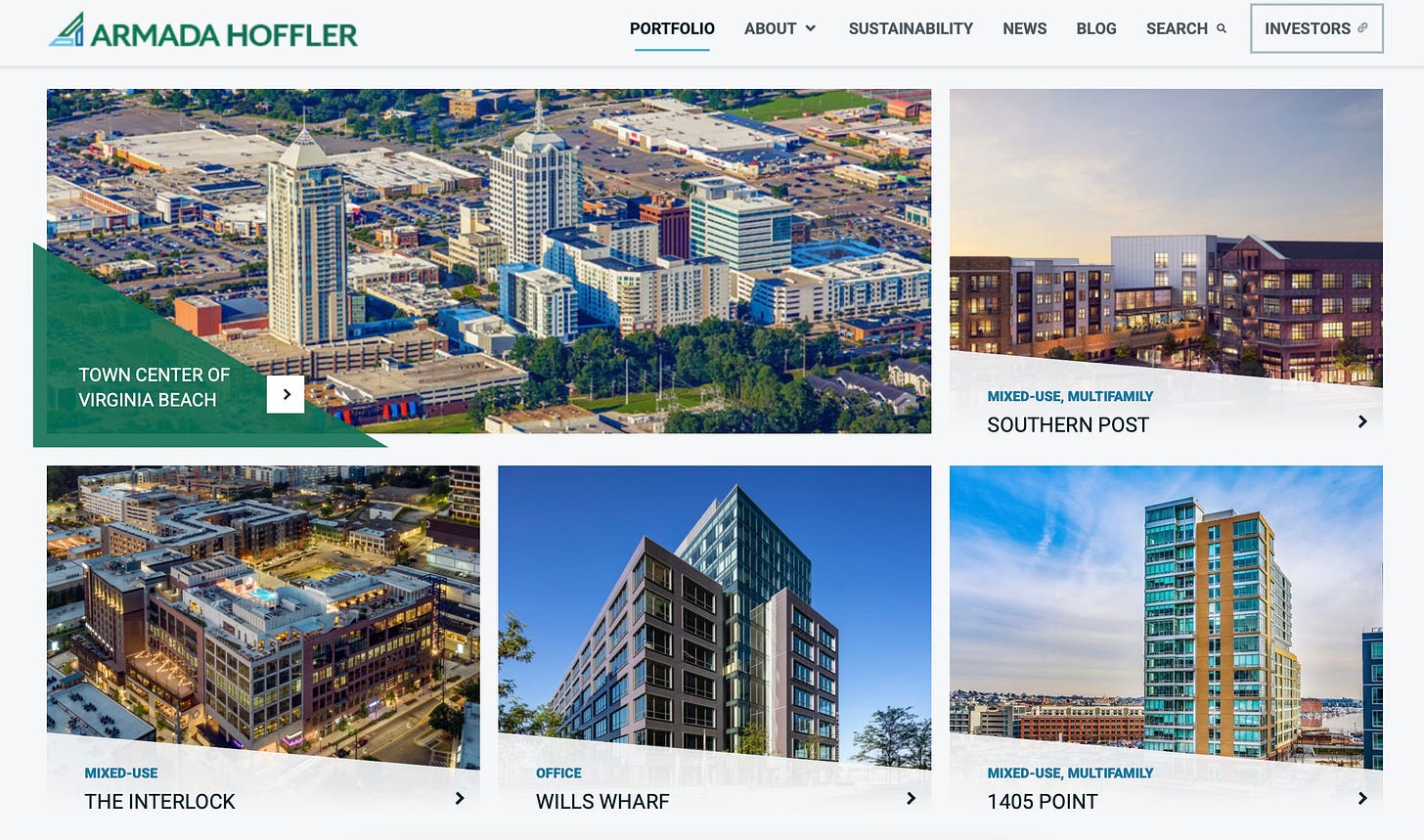

Armada Hoffler Properties (AHH) offers a unique "work, live, play" approach. They develop and manage mixed-use properties that combine apartments, retail, and offices in vibrant urban centers, mainly in the Mid-Atlantic and Southeast. This creates communities where people can live, work, and access services all within walking distance. It's a modern approach that appeals to today's lifestyle preferences.

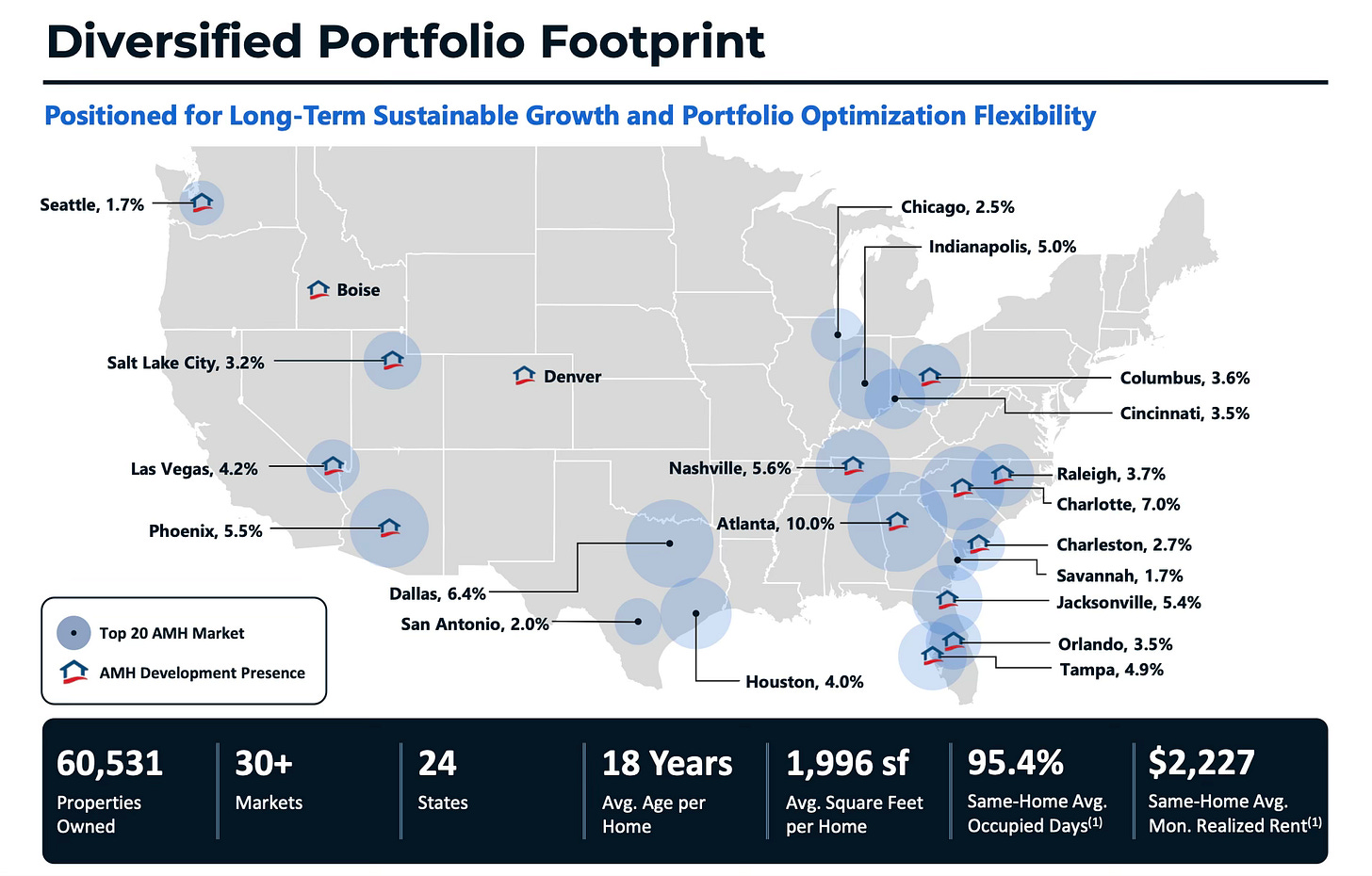

American Homes 4 Rent (AMH) focuses on single-family rental homes, a sector that's grown tremendously in recent years. They buy, renovate, and manage single-family homes in desirable suburban neighborhoods. Recently, they've started building entire rental communities designed specifically for renters. This meets the growing demand from people who want single-family living without the commitment of homeownership.

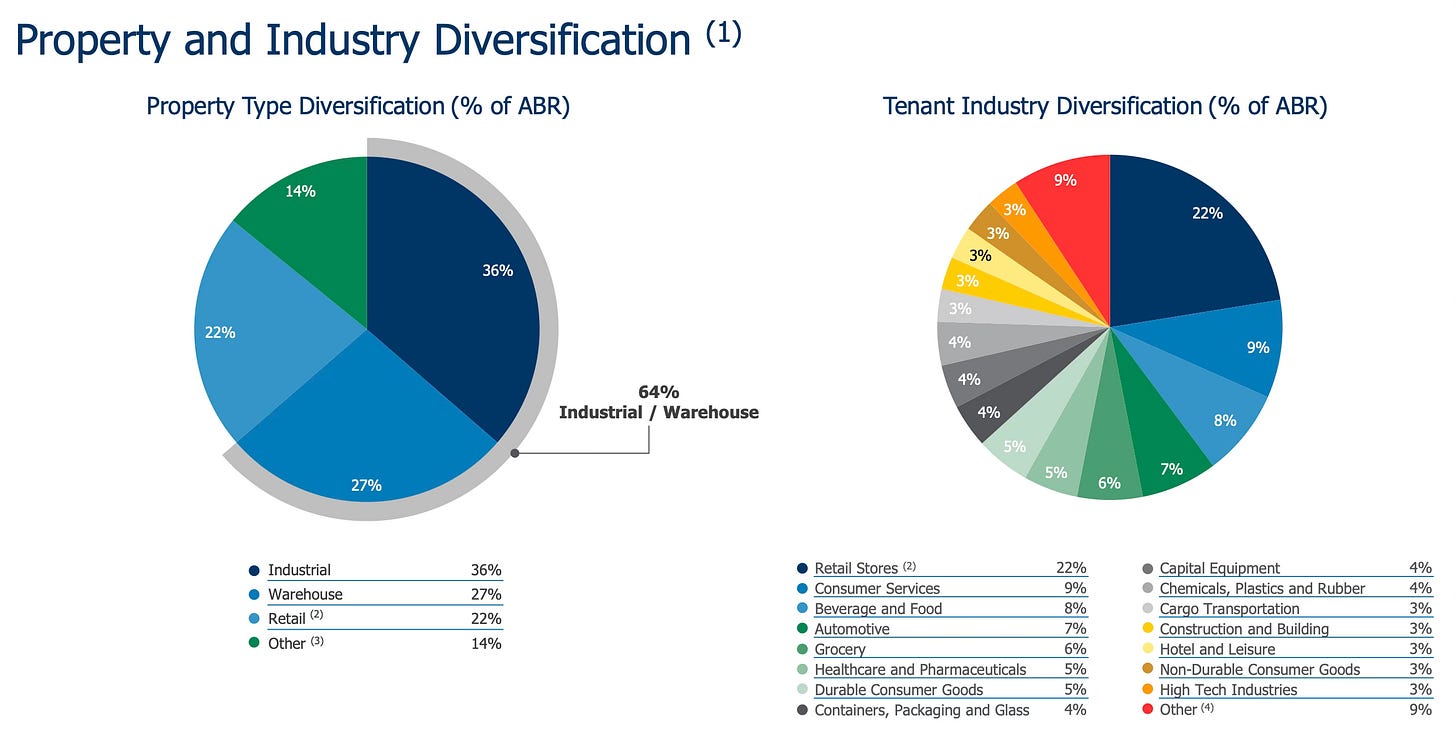

W.P. Carey Inc. (WPC) rounds out my portfolio with global diversification. Operating since 1973, they own industrial, warehouse, office, retail, and self-storage properties across North America and Europe. This international exposure helps protect against regional economic issues. They're known for "sale-leaseback" deals, where they buy properties from companies and lease them back, creating win-win arrangements.

Together, these five REITs give me exposure to many different property types, locations, and economic trends. This diversification helps protect my portfolio from problems in any one sector while positioning it to benefit from growth in multiple areas of real estate.

Building Wealth That Lasts

REITs offer a surprisingly simple path to long-term wealth that can benefit both you and future generations. They provide the perfect mix of steady income and growth potential without property management hassles. The automatic compounding of dividends acts like a wealth snowball, growing bigger over time – even when you're not actively managing it.

The best part? You don't need to be a real estate expert or have a large starting balance. With REITs, anyone can start building real estate wealth through their brokerage account – it's truly a "set it and forget it" approach to becoming a landlord. REITs let you harness the power of real estate while skipping the midnight plumbing emergencies!

Until next time, keep walking!

Jeremy ✌️

And before you leave…

Disclaimer

This article is for informational and educational purposes only. I am not a financial advisor, broker, or tax professional. The information provided reflects my personal opinions and experiences as an individual investor and may not be accurate or current. All investment strategies and investments involve risk of loss. Any ideas presented may not be suitable for all investors and may not take into account your specific investment objectives, financial situation, or needs. Past performance is not indicative of future results. Always conduct your own due diligence and consult with qualified financial professionals before making any investment decisions.